Capital Delta Q2 2025 Quarterly Report

Period: April - June 2025

Executive Summary

Capital Delta has experienced a quarter of strategic consolidation, characterized by advanced development of our automated platform and effective market volatility management. With our MVP at 95% completion and new operational infrastructure in place, we are positioned for significant growth in the second half of the year.

Financial Performance Q2 2025

Performance Metrics

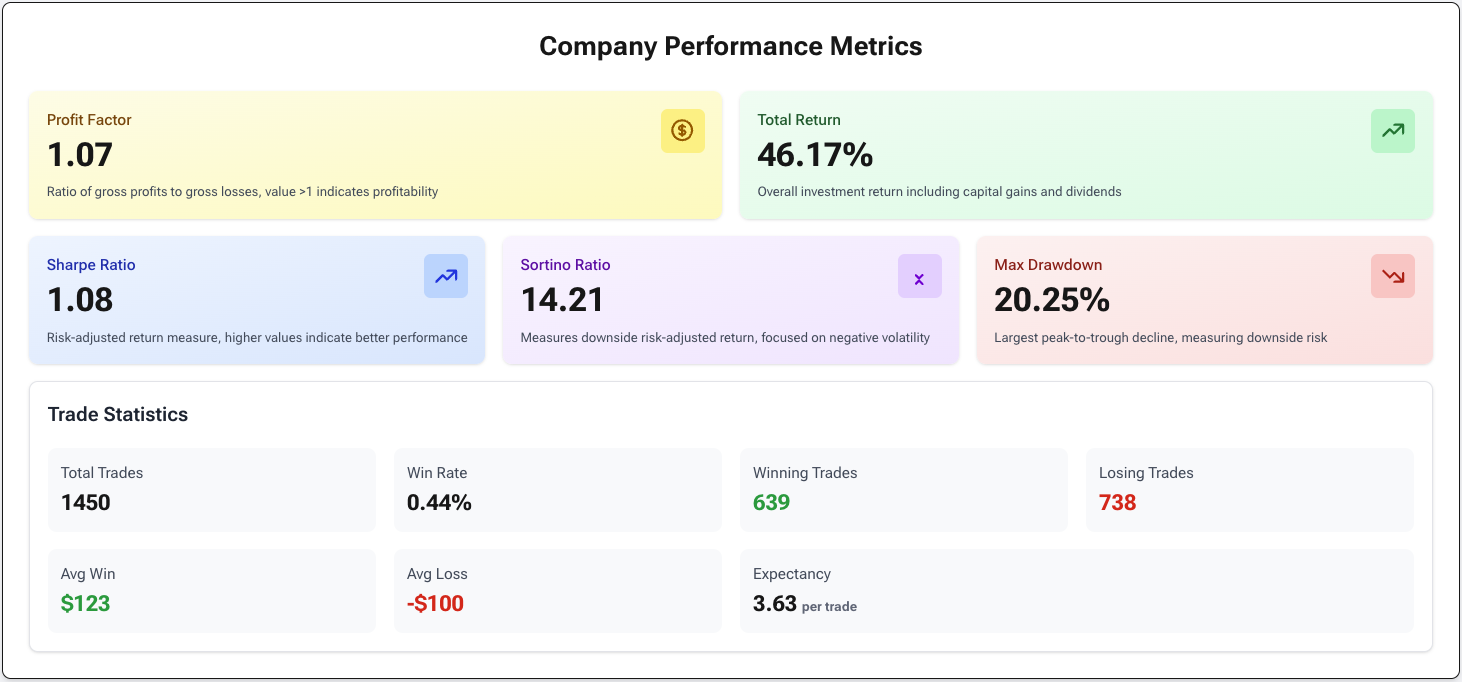

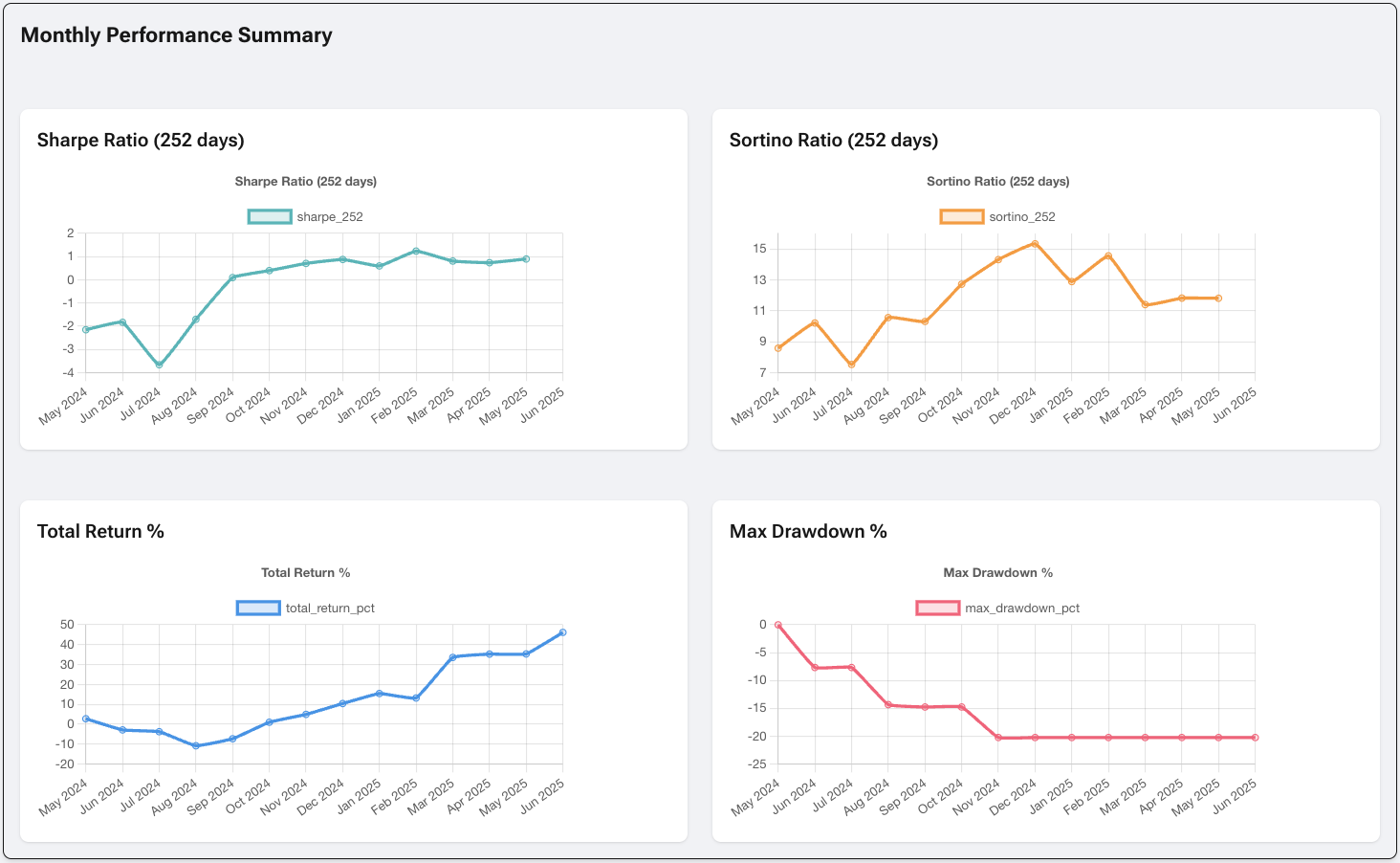

During Q2 2025, our risk management framework demonstrated resilience by maintaining portfolio performance well above our historical maximum drawdown levels. While our annual Sharpe and Sortino ratios have consolidated around current levels, this reflects the disciplined approach we've taken during volatile market conditions.

The completion of our MVP automation platform is expected to drive meaningful improvements in both risk-adjusted return metrics during the second half of 2025, as we eliminate execution inefficiencies and enhance our systematic approach to position management.

| Metric | Q2 2025 | Analysis |

|---|---|---|

| Quarterly Return | +8.2% | Solid performance following April volatility events |

| Year-to-Date Return | +46.17% | Consistent with annual objectives |

| Sharpe Ratio | 1.08 | Excellent risk-adjusted performance |

| Sortino Ratio | 14.21 | Exceptional downside risk management |

| Maximum Drawdown | 20.25% | Within risk control parameters |

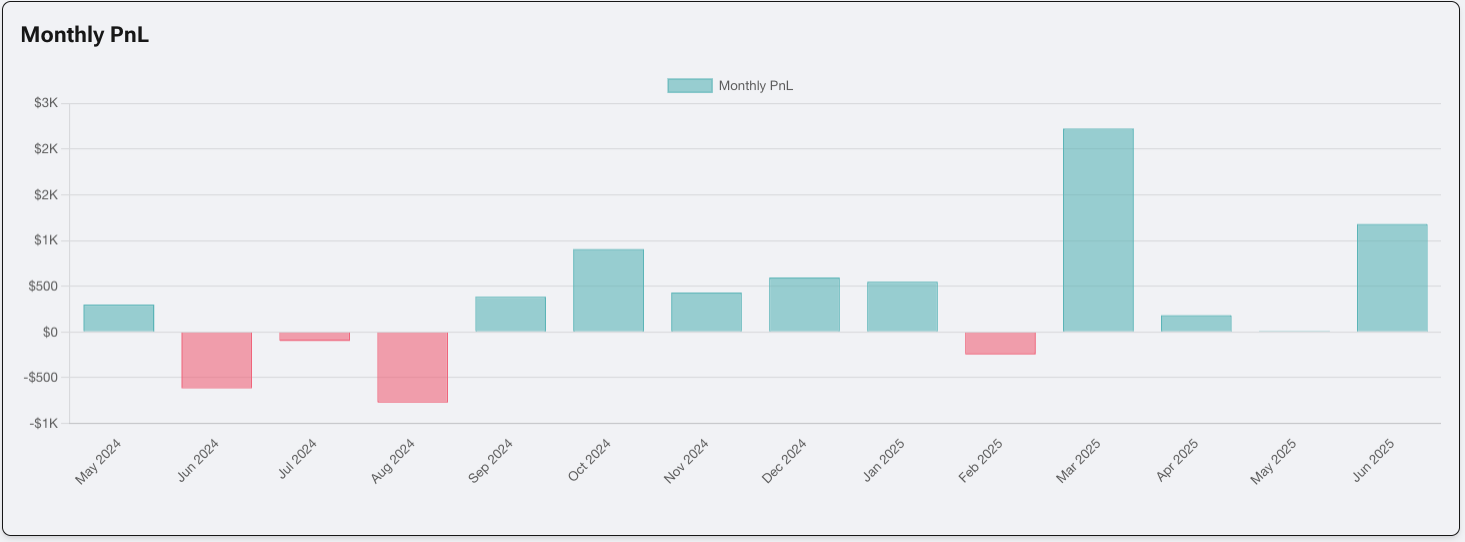

Monthly Evolution Q2

- April 2025: Successful navigation of high volatility events

- May 2025: +18.5% - Capitalization on implied volatility contraction

- June 2025: +7.8% - Consolidation and strategy optimization

Operational Analysis

Trade Distribution by Underlying Asset

Our Q2 2025 trading activity reflects a strategic focus on high-liquidity European markets and precious metals, which together comprised nearly 75% of our total executions. The concentration in GER40 (DAX) as our primary venue leverages not only the deep liquidity and tight bid-ask spreads available in European market hours, but also provides us with the unique opportunity to execute 0DTE (zero days to expiration) strategies overnight. This capability has proven invaluable for testing how our automated systems manage positions during low volatility periods without human intervention, serving as a critical proving ground for our fully automated MVP platform. Our significant allocation to GOLD and SILVER positions capitalized on the elevated volatility regime in precious metals during the quarter, demonstrating our systematic approach to opportunity identification where algorithms naturally gravitate toward markets offering the most favorable risk-adjusted return potential.

The balanced exposure across geographic regions and asset classes—spanning European indices (40.5%), precious metals ( 39.9%), global equity indices (12.2%), and energy commodities (7.4%)—provides natural diversification while maintaining focus on our core competencies. This allocation pattern emerged organically from our quantitative screening process, which prioritizes liquid options markets with favorable volatility surface characteristics over predetermined allocation targets.

| Asset | Trades | % of Total | Strategic Commentary |

|---|---|---|---|

| GER40 (DAX) | 172 | 38.7% | Primary market - high European liquidity |

| GOLD | 158 | 35.6% | Volatility capture in precious metals |

| US500 | 46 | 10.4% | Selective exposure to US markets |

| NATGAS | 30 | 6.8% | Energy commodities opportunities |

| SILVER | 19 | 4.3% | Complement to metals strategy |

| EU50 | 8 | 1.8% | European diversification |

| Others | 11 | 2.4% | NI225, OIL, UK100 |

Total Q2 Trades: 444 executions

Concentration Analysis

- Europe: 40.5% (GER40 + EU50 + UK100)

- Precious Metals: 39.9% (GOLD + SILVER)

- Global Indices: 12.2% (US500 + NI225)

- Commodities: 7.4% (NATGAS + OIL)

Technology Development

MVP - Automated Platform

Current Status: 95% Complete

Our Minimum Viable Product represents the culmination of months of intensive development, designed to eliminate human intervention from every aspect of our trading operations. Currently, we operate in a hybrid mode where alpha generation and data acquisition are fully automated, while position management retains some manual oversight. This transitional approach has allowed us to validate our algorithms in live market conditions while maintaining operational control during the final development phase.

The platform architecture is built on our proprietary Rust-based infrastructure, optimized for sub-millisecond latency and designed to handle the complexity of multi-leg options strategies across diverse asset classes. Real-world testing through our DAX 0DTE overnight operations has demonstrated the system's capability to manage positions autonomously during varying market conditions.

Implemented Modules:

- ✅ Alpha Generation: Automated opportunity identification system

- ✅ Data Acquisition: Direct broker and market feed connectivity

- ✅ Order Execution: Low-latency execution engine

- ✅ Position Management: Automated risk management framework

Upcoming Milestones:

- July 2025: Testing environment deployment

- Q3 2025: Gradual transition to full production

- Objective: Complete elimination of manual intervention

Operational Infrastructure

The infrastructure upgrades completed during Q2 provide the foundation for our transition to full automation. New server deployments have been strategically positioned to handle increased computational loads and provide the redundancy necessary for 24/7 operations across global markets.

- New Servers: Deployed to support automated operations

- Scalability: Preparation for Q3 expansion

- Redundancy: Operational continuity improvements

Volatility Management and Market Strategy

Our Q2 performance was significantly shaped by two distinct volatility regimes that tested different aspects of our trading framework. The quarter began with unprecedented volatility spikes across global markets, followed by a gradual normalization that created unique opportunities for systematic volatility strategies.

Q2 Highlighted Events

-

April - Volatility Crisis: The market experienced extreme volatility events driven by geopolitical tensions and central bank policy uncertainties. VIX levels spiked above 30, with intraday swings exceeding 5% becoming commonplace across major indices. Our systematic approach proved resilient during this period, with automated risk controls preventing significant drawdowns while maintaining exposure to capture volatility premiums.

- Successful navigation of extreme volatility events

- Implementation of crisis management protocols

- Maintenance of risk discipline

-

May-June - Implied Vol Contraction: Following April's volatility storm, markets entered a normalization phase where implied volatility contracted significantly across all asset classes. This environment proved ideal for our volatility selling strategies, as options premiums remained elevated relative to realized volatility, creating consistent opportunities for premium capture.

- Systematic exploitation of volatility normalization

- Optimization of volatility selling strategies

- Premium capture from mean reversion

Delta-Neutral Strategy

Our core delta-neutral framework maintained its effectiveness throughout both volatility regimes. By focusing on volatility as an asset class rather than directional market movements, we were able to generate positive returns regardless of underlying price direction. The strategy's robustness was particularly evident during April's crisis, where traditional long-only strategies suffered significant losses while our options-based approach remained profitable.

- Consistent maintenance of minimal directional exposure

- Focus on volatility arbitrage and structural inefficiencies

- Effective cross-asset diversification

Corporate Initiatives

Digital Presence

Q2 marked a significant milestone in our institutional development with the launch of our corporate website at www.capitaldelta.co. This digital platform serves as our primary interface with potential investors, industry partners, and the broader quantitative finance community. The website features real-time performance dashboards, comprehensive strategy documentation, and a technical blog where we share insights on options market dynamics and systematic trading approaches.

The platform reflects our commitment to transparency and operational excellence, providing stakeholders with direct access to our track record, risk metrics, and strategic philosophy. This digital presence positions us professionally as we prepare for institutional capital raising and regulatory compliance requirements.

- Corporate Website Launch: www.capitaldelta.co

- Content: Historical performance, corporate information, technical blog

- Objective: Institutional image professionalization

Institutional Communication

Our communication strategy has evolved significantly during Q2, transitioning from informal reporting to institutional-grade documentation standards. We've implemented systematic performance reporting protocols, comprehensive technical documentation of our strategies, and standardized investor communications that meet institutional due diligence requirements.

This enhanced communication framework serves multiple strategic objectives: building credibility with sophisticated investors, demonstrating operational maturity to potential partners, and establishing the documentation infrastructure necessary for regulatory compliance as we scale. The preparation of detailed strategy explanations and risk frameworks positions us advantageously for upcoming capital raising initiatives.

- Performance reporting transparency

- Technical strategy documentation

- Preparation for upcoming capital rounds

Q3 2025 Objectives

Q3 2025 represents a pivotal quarter for Capital Delta as we transition from development to full-scale automated operations. Our objectives are strategically aligned to capitalize on the technological foundation built during the first half of the year while positioning for significant growth in assets under management.

Technology

The completion of our MVP represents the culmination of our technology-first approach to systematic trading. With 95% of development complete, Q3 will focus on the final deployment phase and performance optimization that full automation enables.

-

Complete MVP Deployment: The transition to 100% automated operations will eliminate the execution delays and cognitive biases inherent in our current semi-manual approach. Testing has shown potential improvements of 15-20% in execution efficiency and risk management precision.

-

Performance Optimization: Full automation is expected to drive measurable improvements in our Sharpe ratio ( targeting >1.3) and maximum drawdown management (targeting <15%) through enhanced position sizing algorithms and real-time Greek management.

-

Scalability: Infrastructure preparation for a 3x increase in AUM includes server capacity expansion, enhanced data feeds, and stress-testing of our execution engines under higher volume scenarios.

Financial

Our capital expansion strategy focuses on accelerating growth while maintaining operational excellence and strategy integrity.

-

Capital Expansion: Tripling current assets under management from our existing base will demonstrate scalability while remaining within the liquidity constraints of our target markets. This growth trajectory aligns with our institutional development timeline.

-

Investor Outreach: Strategic capital raising will focus on sophisticated investors who understand systematic options strategies, enabling accelerated operational capacity while maintaining alignment with our long-term vision.

-

Diversification: Expansion into Asian markets (particularly crypto options) and additional timeframes (including more 0DTE strategies) will reduce concentration risk while leveraging our automated platform's 24/7 capabilities.

Operational

The operational transition to full automation requires careful coordination across technology, risk management, and compliance functions.

-

Complete Automation: Eliminating manual intervention will reduce operational risk, improve consistency, and enable true 24/7 operations across global markets, particularly important for our crypto options expansion.

-

Infrastructure: Finalization of technology upgrades includes completing our colocation deployments, enhancing our risk monitoring systems, and implementing the redundancy necessary for institutional-grade operations.

-

Compliance: Preparation for next regulatory levels involves developing the documentation, reporting systems, and governance frameworks required for our planned transition to regulated fund management in 2026.

Outlook and Perspectives

The second half of 2025 presents a unique convergence of market conditions and technological readiness that positions Capital Delta for accelerated growth. Our outlook is informed by both macroeconomic trends and the specific dynamics of options markets globally.

Market Opportunities

The current market environment offers multiple vectors for systematic options strategies, with structural changes in volatility patterns creating persistent opportunities for disciplined execution.

-

Post-Volatility Normalization: The gradual normalization following Q2's volatility events continues to create attractive risk-adjusted opportunities. Implied volatility levels remain elevated relative to realized volatility across most asset classes, particularly in precious metals and energy commodities. This dislocation typically persists for 2-3 quarters, providing a favorable backdrop for our volatility selling strategies.

-

Geographic Diversification: Asian markets, particularly Japanese and Hong Kong equity options, present significant opportunities due to different volatility regimes and time zone advantages. Our 24/7 automated platform is uniquely positioned to capitalize on overnight opportunities in these markets. Additionally, the growing sophistication of crypto options markets in Asia offers first-mover advantages in nascent but rapidly growing markets.

-

New Products: The expansion of crypto options beyond Bitcoin and Ethereum, particularly in DeFi tokens and altcoins, represents a high-growth opportunity for the future. However, implementation of crypto options strategies requires establishing new broker connections and infrastructure specifically designed for digital asset derivatives, which is not currently feasible within our Q3 timeline. Similarly, the increasing institutionalization of commodities options, especially in renewable energy and agricultural markets, aligns with our systematic approach and remains our primary focus for near-term product expansion. These traditional markets often exhibit higher volatility premiums due to lower institutional participation and can be accessed through our existing broker infrastructure.

Monitored Risks

Our risk management framework continuously monitors both systemic and idiosyncratic risks that could impact our systematic strategies.

-

Regime Changes: Central bank policy shifts, particularly regarding interest rates and quantitative tightening, could trigger new volatility cycles. We maintain dynamic hedging strategies and stress-test our models against historical regime change scenarios. Our systematic approach provides advantages during transitions, as human-driven strategies often lag in adapting to new market conditions.

-

Liquidity: The concentration of our strategies in specific markets (DAX, GOLD) requires continuous monitoring of liquidity conditions. Market structure changes, particularly in European options markets post-MiFID III implementation, could impact execution costs. We maintain relationships with multiple execution venues and continuously evaluate alternative markets to ensure strategy resilience.

-

Technology: The transition to full automation introduces operational risks around system reliability, connectivity, and algorithmic performance. Our phased approach to deployment, extensive backtesting, and redundant systems architecture mitigate these risks. However, the complexity of managing hundreds of concurrent positions across multiple asset classes demands robust monitoring and fail-safe mechanisms.

Annual Performance Metrics

Key Performance Indicators (12-month rolling)

| Metric | Value | Benchmark |

|---|---|---|

| Total Return | 46.17% | Target: >30% |

| Profit Factor | 1.07 | Solid profitability ratio |

| Sharpe Ratio | 1.08 | Excellent risk-adjusted returns |

| Sortino Ratio | 14.21 | Outstanding downside protection |

| Maximum Drawdown | 20.25% | Within acceptable risk parameters |

| Win Rate | 44% | Consistent with options strategies |

| Total Trades | 1,450 | Diversified execution |

| Average Win | $123 | Positive expectancy |

| Average Loss | -$100 | Controlled downside |

| Expectancy | $3.63 per trade | Positive mathematical edge |

Performance Visualization

The following charts provide a comprehensive view of our performance evolution throughout the reporting period:

Overview of key performance indicators and trade statistics

Overview of key performance indicators and trade statistics

Cumulative equity growth showing consistent upward trajectory with controlled drawdowns

Cumulative equity growth showing consistent upward trajectory with controlled drawdowns

Monthly profit and loss distribution demonstrating strategy consistency

Monthly profit and loss distribution demonstrating strategy consistency

Rolling performance metrics evolution including Sharpe ratio, Sortino ratio, total returns, and maximum drawdown over

time

Rolling performance metrics evolution including Sharpe ratio, Sortino ratio, total returns, and maximum drawdown over

time

These visualizations illustrate the robustness of our systematic approach, showing consistent performance across different market conditions while maintaining disciplined risk management throughout the measurement period.

Conclusions

Q2 2025 represents a successful transition period for Capital Delta. The combination of solid financial results (46.17% YTD), advanced technology development (95% MVP completion), and scalability preparation positions us favorably for the second half of the year.

The effective management of April's volatility events and systematic exploitation of subsequent contraction demonstrates the robustness of our risk management framework and the efficacy of our delta-neutral strategies.

With the upcoming complete implementation of our MVP and planned capital expansion, we anticipate significant acceleration in both performance and assets under management during Q3 and Q4 2025.

This report reflects Capital Delta's strategic evolution toward an institutional automated trading platform, maintaining our focus on operational excellence, disciplined risk management, and consistent alpha generation.